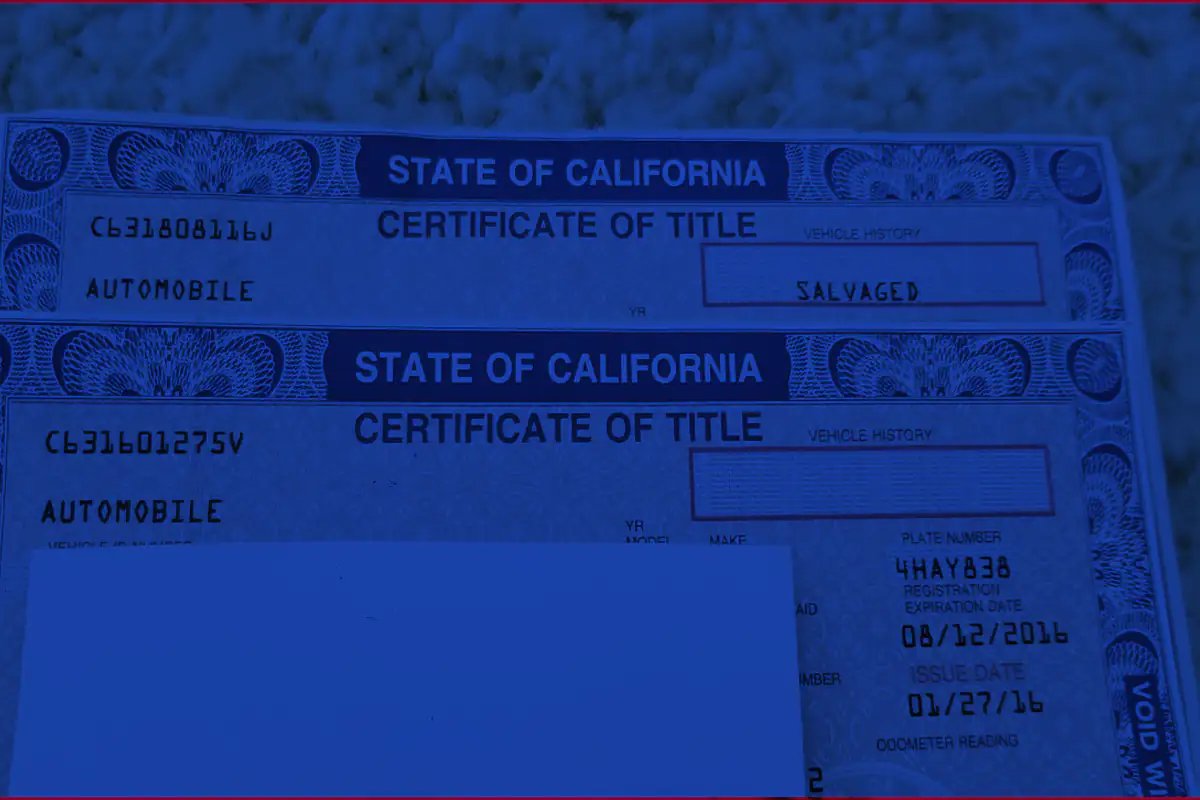

Undisclosed Branded Title

Repossession occurs when a lender takes back a vehicle, from a borrower, due to breaching the terms of the loan, such as failing to make payments as agreed in the loan contract or maintaining insurance on the vehicle. In This action is legal and can be initiated without a court order, provided it does not breach the peace. A breach of the peace occurs when the lender or repossession agent uses force, threats, or any other aggressive tactics to take possession of the vehicle. This can include actions such as breaking into a locked garage, physically removing the borrower from the vehicle, or engaging in verbal or physical altercations.

1. Increased Cost of Maintenance:

Vehicles with branded titles, such as salvage, rebuilt, or flood-damaged titles, often come with hidden damage or structural issues. These issues may not be immediately apparent to buyers but can lead to increased maintenance costs down the line. Branded title vehicles may require frequent repairs or replacements of essential components, driving up the overall cost of ownership for unsuspecting buyers.

2. Increased Chance of Odometer Tampering:

Branded title vehicles are often subjected to significant damage, which may prompt unscrupulous sellers to engage in odometer tampering. Since branded title vehicles typically have lower market value due to their history, some sellers may attempt to roll back the odometer to make the vehicle appear more desirable and command a higher price. This can deceive buyers into believing they are purchasing a vehicle with lower mileage, leading to inaccurate maintenance schedules and potential safety hazards.

3. Impact on Resale or Trade-In Value:

A branded title significantly diminishes the resale or trade-in value of a vehicle. Many consumers are wary of purchasing vehicles with branded titles due to concerns about their safety, reliability, and potential future problems. As a result, owners of branded title vehicles may struggle to sell or trade in their vehicles for a fair price, leading to financial losses.

4. Florida Law Requirements for Disclosure of Branded Titles:

Under Florida law, dealerships are required to disclose if a vehicle’s title has been branded. This includes the vehicle’s branded title status, such as salvage, rebuilt, lemon law buy-back or flood-damaged titles. Failure to disclose this information constitutes a violation of the Florida Deceptive and Unfair Trade Practices Act (FDUTPA) and may subject the dealership to legal action.

5. Legal Damages for Undisclosed Branded Titles:

If a dealership fails to disclose a vehicle’s branded title status to a consumer, the consumer may have grounds for legal action. Potential damages that a consumer could sue a dealership for due to an undisclosed branded title include compensation for financial losses incurred as a result of purchasing the vehicle, such as repair costs, diminished value, and other related expenses. Additionally, the consumer may seek punitive damages to deter similar conduct in the future and to hold the dealership accountable for its actions. In some circumstances, a consumer could be entitled to $10,000 in statutory damages.